Dockside Safety, Shore-Side Peace of Mind

Protecting the Hands That Move the World

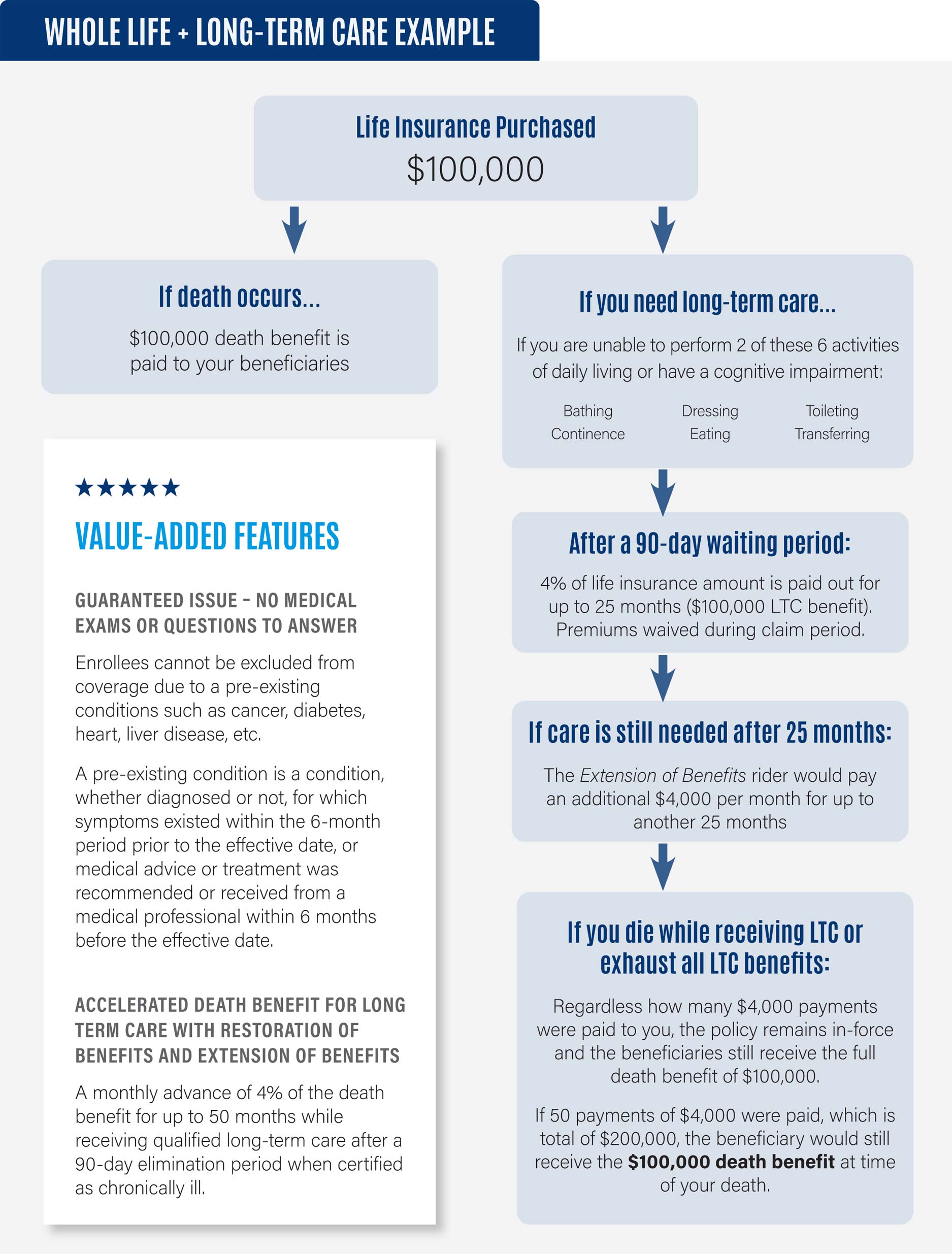

■ Group Whole Life Insurance with 2x Long-Term Care Benefits

■ Guaranteed Issue Coverage

Coverage Details

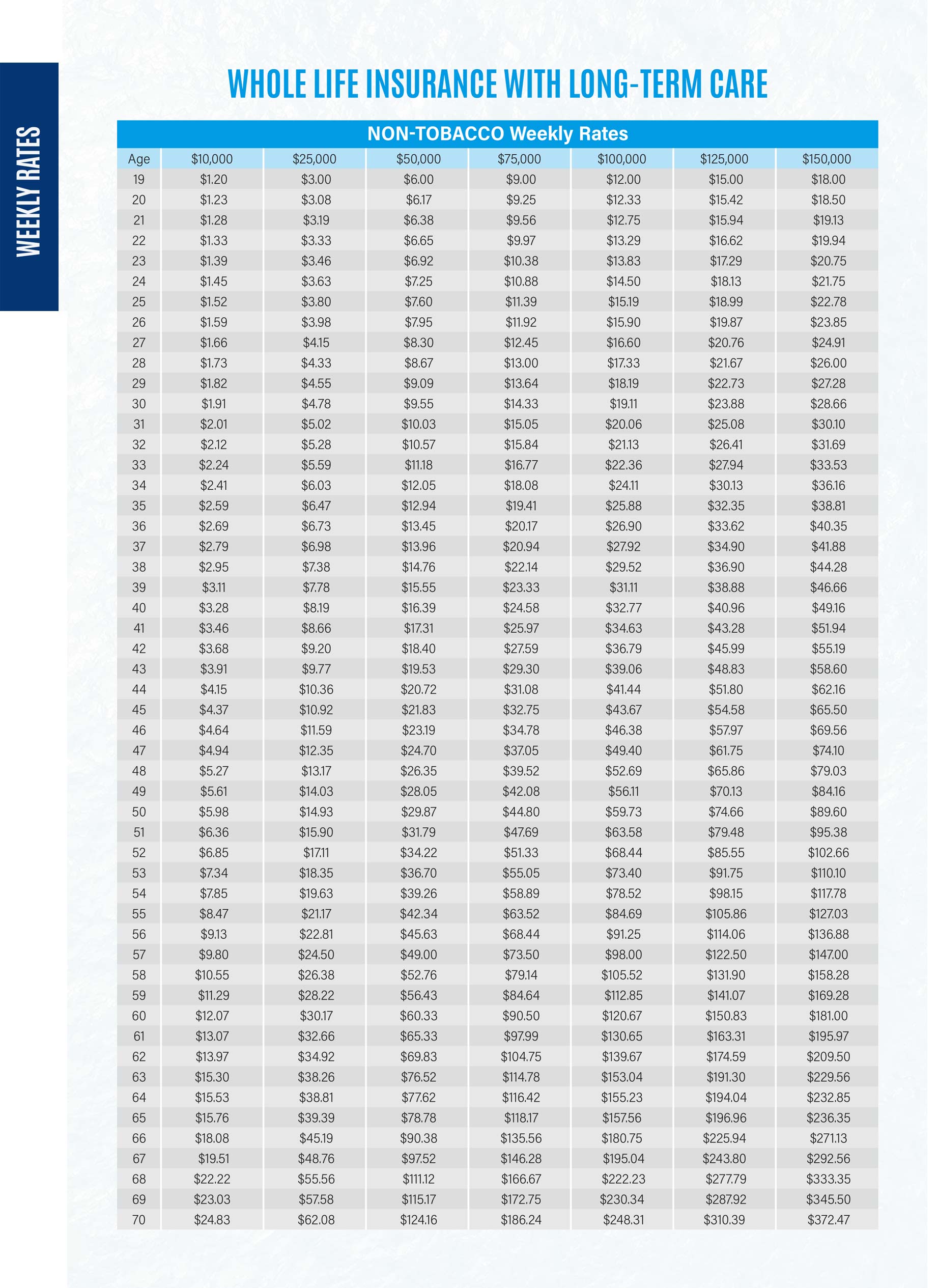

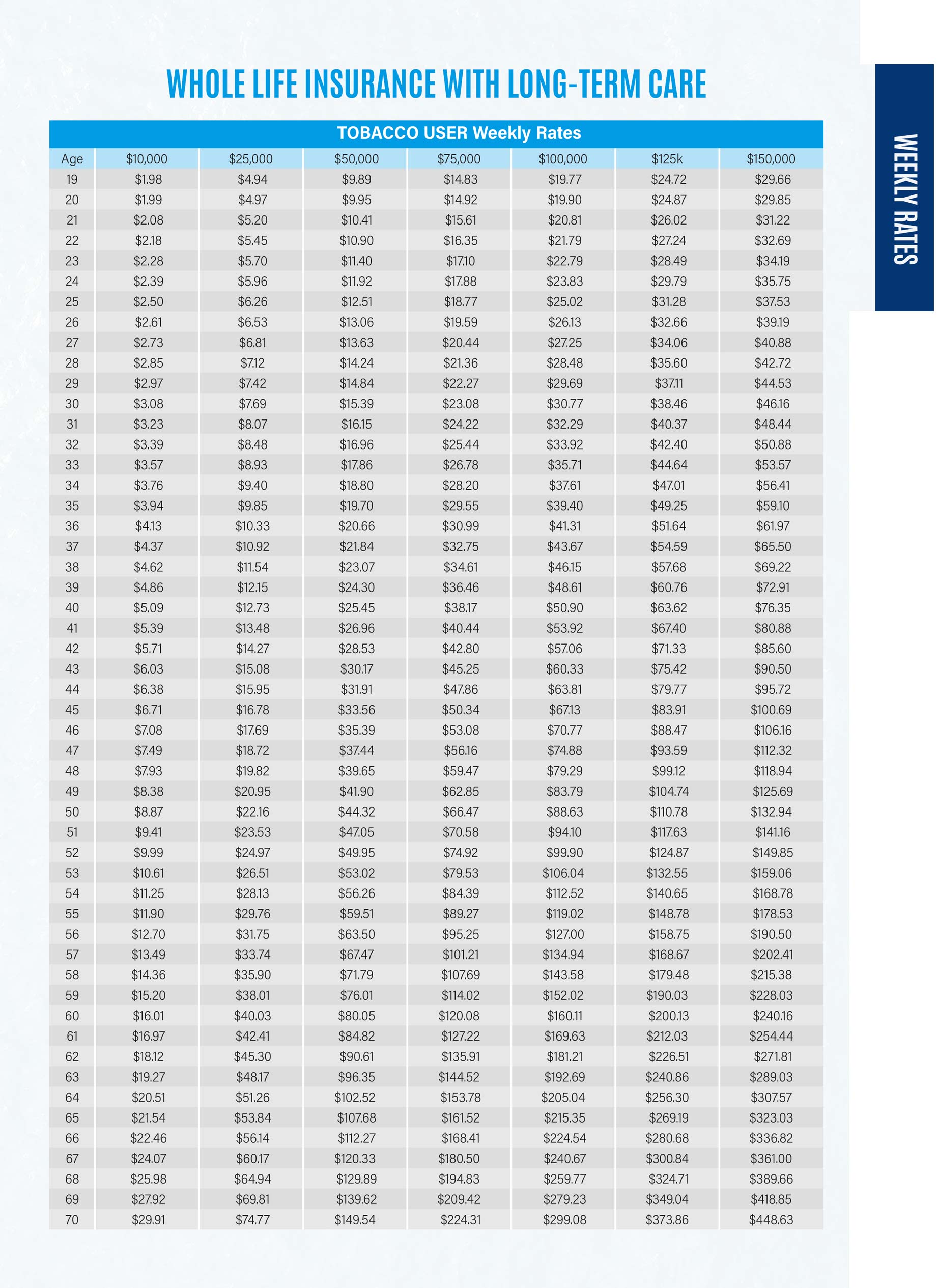

Issue Ages

– Member: 18 – 80 Years

– Spouse: 18 – 80 Years

– Children: 1 day – 18 years

Guaranteed Issue Maximums

– Member (18-70): $150,000

– Spouse (Working): $75,000

– Spouse (Non-Working): $20,000

Simplified Issue Maximums

– Member (18-80): $250,000

– Spouse (Working): $150,000

– Spouse (Non-Working): $50,000

PLAN DETAILS

– Whole Life Insurance has fixed premiums to age 95 and the death benefit is guaranteed to age 100. By electing coverage, it guarantees that you have death benefits and/or living benefits available when needed as long as premiums are paid.

– Whole Life Insurance Long-Term Care Policy pays 4% per month for up to 50 months (4.2 years) if long-term care is needed. The following illustrates a $100,000 policy. The policy would pay $4,000 a month up to 50 months and the death benefit still pays.

POINTS TO PONDER

– Guaranteed issue period this year offers coverage with NO medical questions asked.

– Price lock guarantees your cost will not increase once coverage is elected.

– The life insurance is permanent and is portable when you retire or change jobs.

– Provides funding for long-term care expenses, if the need were to arise.

– Coverage is available for spouses and children if elected for Member.

– Cash value growth that can be used for emergencies.

MEMBER ELIGIBILITY: The coverage offers fully guaranteed premiums payable to age 95, death benefits and cash value that can be used along the way. Members enjoy Guaranteed Issue up to $150,000 in Face Amount. Up to $250,000 with medical questions.

SPOUSE ELIGIBILITY: Maximum Face Amount of Guaranteed Issue Life Insurance up to $75,000. Spouse is eligible for up to $150,000 in coverage with medical questions. At the time of issue, must be between the ages of 18 & 65, legally married to the member of the ILA, and not be disabled.

CHILD ELIGIBILITY: Children’s Term Rider; level term insurance, of $20,000 for each covered dependent child under the age 26, for $4.78 per month. Not available if the dependent child is covered under a separate certificate.